# To install a package, run the following ONCE (and only once on your computer)

# install.packages("psych")

library(psych, include.only = "pairs.panels") # for scatterplot matrix

library(here) # makes reading data more consistent

library(tidyverse) # for data manipulation and plotting

library(car) # some useful functions for regression

library(modelsummary) # for making tables

library(sjPlot) # for plotting slopes

library(interactions) # for plotting interactionsWeek 2 (R): Regression

Load Packages and Import Data

You can use add the message = FALSE option to suppress the package loading messages

Import Data

First, download the data file salary.txt from https://raw.githubusercontent.com/marklhc/marklai-pages/master/data_files/salary.txt, and import the data. A robust way to do so is to download the data to a folder called data_files under the project directory, and then use the here package. This avoids a lot of data import issues that I’ve seen.

# The `here()` function forces the use of the project directory

here("data_files", "salary.txt")

# Read in the data

salary_dat <- read.table(here("data_files", "salary.txt"), header = TRUE)Alternatively, from the menu, click File → Import Dataset → From Text (base)..., and select the file.

# Show the data

salary_datid <int> | time <int> | pub <int> | sex <int> | citation <int> | salary <int> |

|---|---|---|---|---|---|

| 1 | 3 | 18 | 1 | 50 | 51876 |

| 2 | 6 | 3 | 1 | 26 | 54511 |

| 3 | 3 | 2 | 1 | 50 | 53425 |

| 4 | 8 | 17 | 0 | 34 | 61863 |

| 5 | 9 | 11 | 1 | 41 | 52926 |

| 6 | 6 | 6 | 0 | 37 | 47034 |

| 7 | 16 | 38 | 0 | 48 | 66432 |

| 8 | 10 | 48 | 0 | 56 | 61100 |

| 9 | 2 | 9 | 0 | 19 | 41934 |

| 10 | 5 | 22 | 0 | 29 | 47454 |

You can see the description of the variables here: https://rdrr.io/cran/MBESS/man/prof.salary.html

Quick Scatterplot Matrix

Import to screen your data before any statistical modeling

pairs.panels(salary_dat[, -1], # not plotting the first column

ellipses = FALSE

)

1. Linear Regression of salary on pub

Visualize the data

# Visualize the data ("gg" stands for grammar of graphics)

p1 <- ggplot(

salary_dat, # specify data

# aesthetics: mapping variable to axes)

aes(x = pub, y = salary)

) +

# geom: geometric objects, such as points, lines, shapes, etc

geom_point()

# Add a smoother geom to visualize mean salary as a function of pub

p1 + geom_smooth()># `geom_smooth()` using method = 'loess' and formula = 'y ~ x'

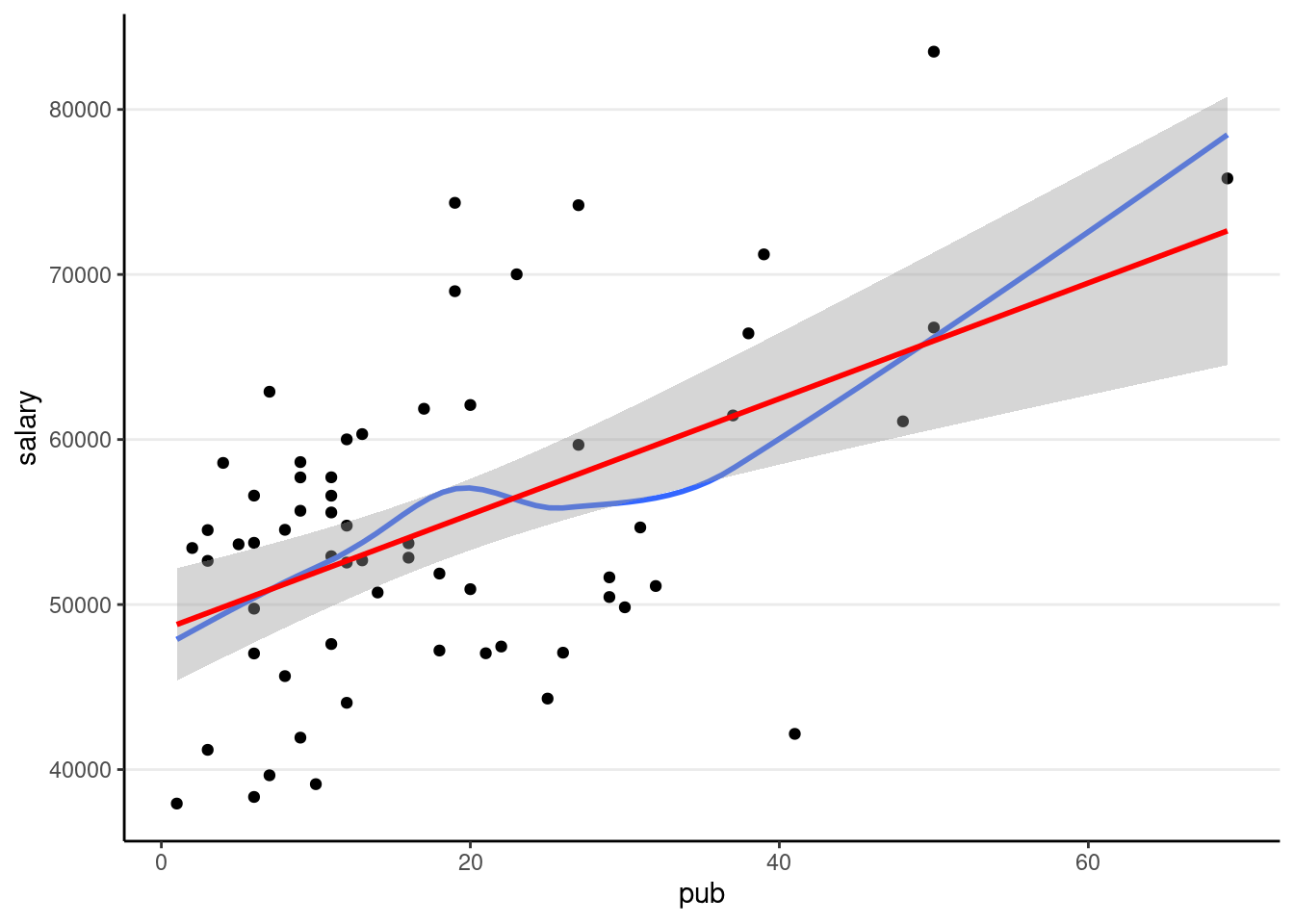

A little bit of non-linearity on the plot. Now fit the regression model

Linear regression

You can type equations (with LaTeX; see a quick reference).

P.S. Use \text{} to specify variable names

P.S. Pay attention to the subscripts

- Outcome:

salary - Predictor:

pub

# left hand side of ~ is outcome; right hand side contains predictors

# salary ~ (beta_0) * 1 + (beta_1) * pub

# remove beta_0 and beta_1 to get the formula

m1 <- lm(salary ~ 1 + pub, data = salary_dat)

# In R, the output is not printed out if it is saved to an object (e.g., m1).

# Summary:

summary(m1)>#

># Call:

># lm(formula = salary ~ 1 + pub, data = salary_dat)

>#

># Residuals:

># Min 1Q Median 3Q Max

># -20660.0 -7397.5 333.7 5313.9 19238.7

>#

># Coefficients:

># Estimate Std. Error t value Pr(>|t|)

># (Intercept) 48439.09 1765.42 27.438 < 2e-16 ***

># pub 350.80 77.17 4.546 2.71e-05 ***

># ---

># Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

>#

># Residual standard error: 8440 on 60 degrees of freedom

># Multiple R-squared: 0.2562, Adjusted R-squared: 0.2438

># F-statistic: 20.67 on 1 and 60 DF, p-value: 2.706e-05Visualize fitted regression line:

p1 +

# Non-parametric fit

geom_smooth(se = FALSE) +

# Linear regression line (in red)

geom_smooth(method = "lm", col = "red")># `geom_smooth()` using method = 'loess' and formula = 'y ~ x'

># `geom_smooth()` using formula = 'y ~ x'

Confidence intervals

# Confidence intervals

confint(m1)># 2.5 % 97.5 %

># (Intercept) 44907.729 51970.4450

># pub 196.441 505.1625Interpretations

Based on our model, faculty with one more publication have predicted salary of $350.8, 95% CI [$196.4, $505.2], higher than those with one less publication.

But what do the confidence intervals and the standard errors mean? To understanding what exactly a regression model is, let’s run some simulations.

Simulations

Before you go on, take a look on a brief introductory video by Clark Caylord on Youtube on simulating data based on a simple linear regression model.

Based on the analyses, the sample regression line is salary and pub, then we can simulate some fake data, which represents what we could have obtained in a different sample.

Going back to the equation Residual standard error = 8,440.

Based on these model assumptions, we can imagine a large population, say with 10,000 people

# Simulating a large population. The code in this chunk

# is not essential for conceptual understanding

Npop <- 10000

beta0 <- 48439.09

beta1 <- 350.80

sigma <- 8440

# Simulate population data

simulated_population <- tibble(

# Simulate population pub

pub = local({

dens <- density(c(-salary_dat$pub, salary_dat$pub),

bw = "SJ",

n = 1024

)

dens_x <- c(0, dens$x[dens$x > 0])

dens_y <- c(0, dens$y[dens$x > 0])

round(

approx(

cumsum(dens_y) / sum(dens_y),

dens_x,

runif(Npop)

)$y

)

}),

# Simulate error

e = rnorm(Npop, mean = 0, sd = sigma)

)

# Compute salary variable

simulated_population$salary <-

beta0 + beta1 * simulated_population$pub + simulated_population$e

# Plot

p_pop <- ggplot(

data = simulated_population,

aes(x = pub, y = salary)

) +

geom_point(alpha = 0.1) +

# Add population regression line in blue

geom_smooth(se = FALSE, method = "lm")

p_pop># `geom_smooth()` using formula = 'y ~ x'

Now, we can simulate some fake (but plausible) samples. An important thing to remember is we want to simulate data that have the same size as the original sample, because we’re comparing to other plausible samples with equal size. In R there is a handy simulate() function to do that.

simulated_salary <- simulate(m1)

# Add simulated salary to the original data

# Note: the simulated variable is called `sim_1`

sim_data1 <- bind_cols(salary_dat, simulated_salary)

# Show the first six rows

head(sim_data1)id <int> | time <int> | pub <int> | sex <int> | citation <int> | salary <int> | sim_1 <dbl> | |

|---|---|---|---|---|---|---|---|

| 1 | 1 | 3 | 18 | 1 | 50 | 51876 | 72280.05 |

| 2 | 2 | 6 | 3 | 1 | 26 | 54511 | 53094.60 |

| 3 | 3 | 3 | 2 | 1 | 50 | 53425 | 41655.61 |

| 4 | 4 | 8 | 17 | 0 | 34 | 61863 | 53819.46 |

| 5 | 5 | 9 | 11 | 1 | 41 | 52926 | 45657.48 |

| 6 | 6 | 6 | 6 | 0 | 37 | 47034 | 54205.30 |

# Plot the data (add on to the population)

p_pop +

geom_point(

data = sim_data1,

aes(x = pub, y = sim_1),

col = "red"

) +

# Add sample regression line

geom_smooth(

data = sim_data1,

aes(x = pub, y = sim_1),

method = "lm", se = FALSE, col = "red"

)># `geom_smooth()` using formula = 'y ~ x'

># `geom_smooth()` using formula = 'y ~ x'

# To be more transparent, here's what the simulate() function essentially is

# doing

sample_size <- nrow(salary_dat)

sim_data1 <- tibble(

pub = salary_dat$pub,

# simulate error

e = rnorm(sample_size, mean = 0, sd = sigma)

)

# Compute new salary data

sim_data1$sim_1 <- beta0 + beta1 * sim_data1$pub + sim_data1$eAs you can see, the sample regression line in red is different from the blue line.

Drawing 100 samples

Let’s draw more samples

num_samples <- 100

simulated_salary100 <- simulate(m1, nsim = num_samples)

# Form a giant data set with 100 samples

sim_data100 <- bind_cols(salary_dat, simulated_salary100) %>%

pivot_longer(sim_1:sim_100,

names_prefix = "sim_",

names_to = "sim",

values_to = "simulated_salary"

)

# Plot by samples

p_sim100 <- ggplot(

sim_data100,

aes(x = pub, y = simulated_salary, group = sim)

) +

geom_point(col = "red", alpha = 0.1) +

geom_smooth(col = "red", se = FALSE, method = "lm")

# Code for generating GIF

# # Use gganimate (this takes some time to render)

# library(gganimate)

# p_sim100 + transition_states(sim) +

# ggtitle("Simulation {frame} of {nframes}")

# anim_save("sim-100-samples.gif")

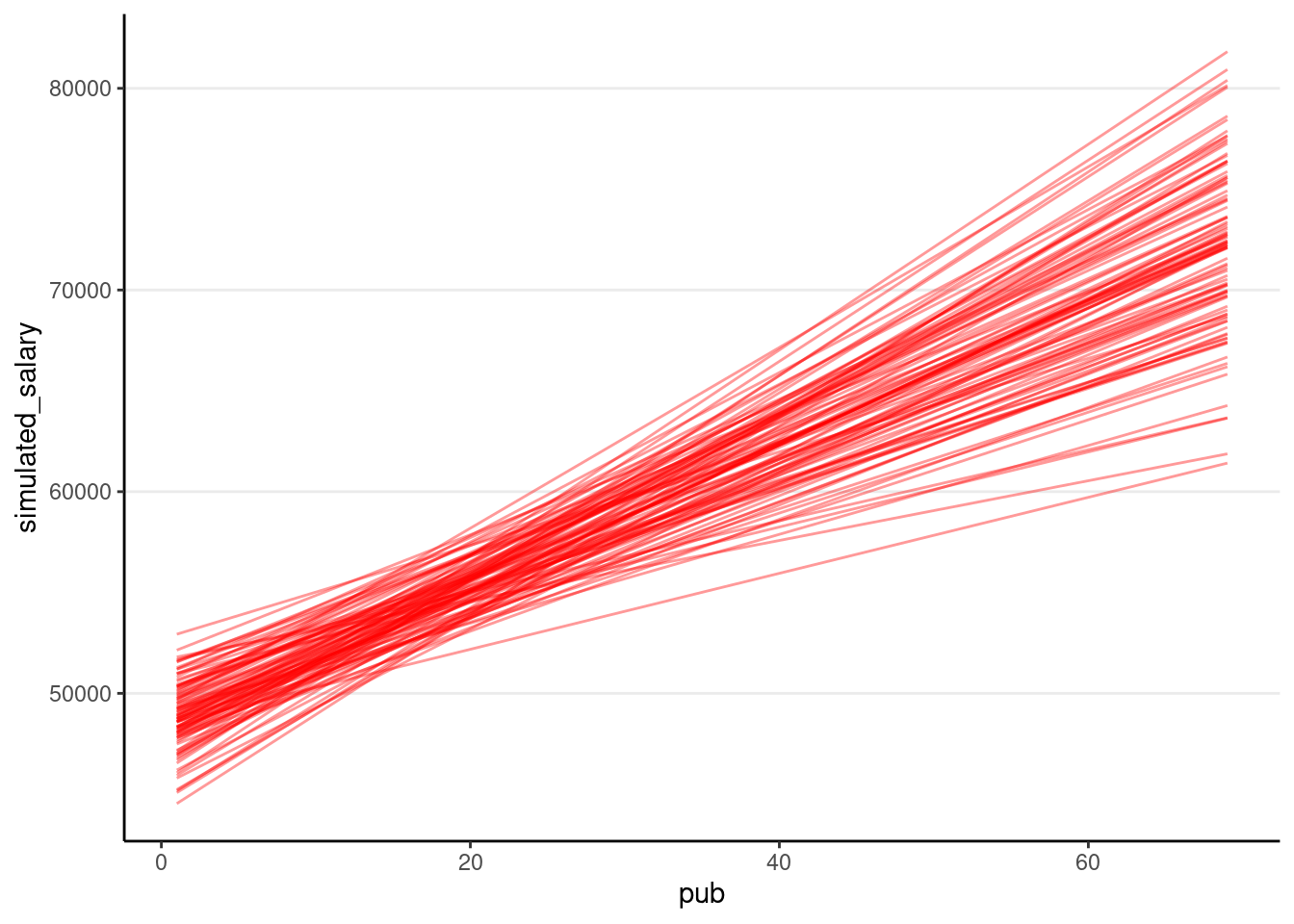

We can show the regression lines for all 100 samples

ggplot(

sim_data100,

aes(x = pub, y = simulated_salary, group = sim)

) +

stat_smooth(

geom = "line",

col = "red",

se = FALSE,

method = "lm",

alpha = 0.4

)># `geom_smooth()` using formula = 'y ~ x'

The confidence intervals of the intercept and the slope how much uncertainty there is.

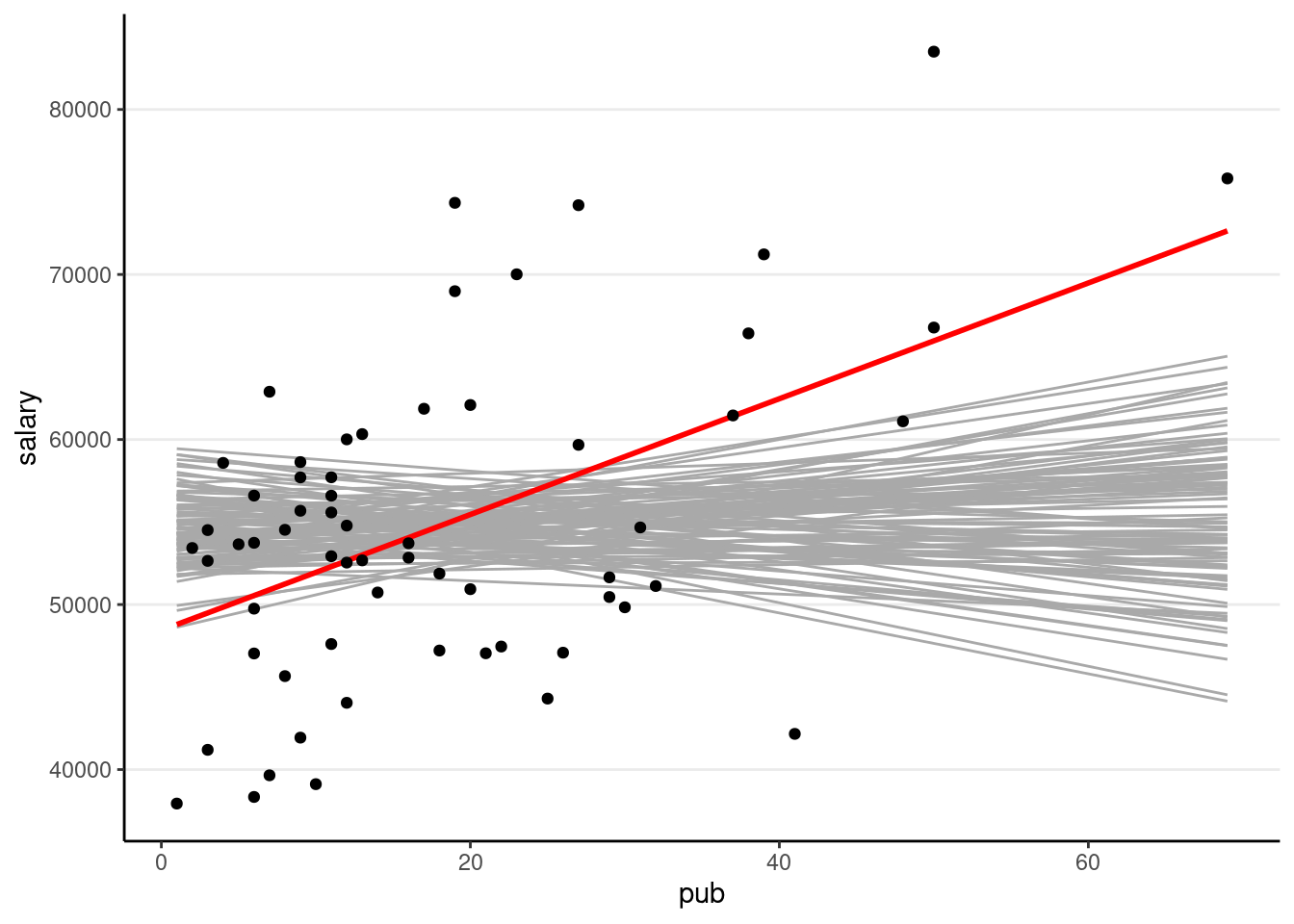

Now, we can also understand the pub is. Remember that the pub is zero (i.e., no association), how likely/unlikely would we get the sample slope (i.e., 350.80) in our data. So now we’ll repeat the simulation, but without pub as a predictor (i.e., assuming

num_samples <- 100

m0 <- lm(salary ~ 1, data = salary_dat) # null model

simulated_salary100_null <- simulate(m0, nsim = num_samples)

# Form a giant data set with 100 samples

sim_null100 <- bind_cols(salary_dat, simulated_salary100_null) %>%

pivot_longer(sim_1:sim_100,

names_prefix = "sim_",

names_to = "sim",

values_to = "simulated_salary"

)

# Show the null slopes

ggplot(

data = salary_dat,

aes(x = pub, y = salary)

) +

stat_smooth(

data = sim_null100,

aes(x = pub, y = simulated_salary, group = sim),

geom = "line",

col = "darkgrey",

se = FALSE,

method = "lm"

) +

geom_smooth(method = "lm", col = "red", se = FALSE) +

geom_point()># `geom_smooth()` using formula = 'y ~ x'

># `geom_smooth()` using formula = 'y ~ x'

So you can see the sample slope is larger than what you would expect to see if the true slope is zero. So the

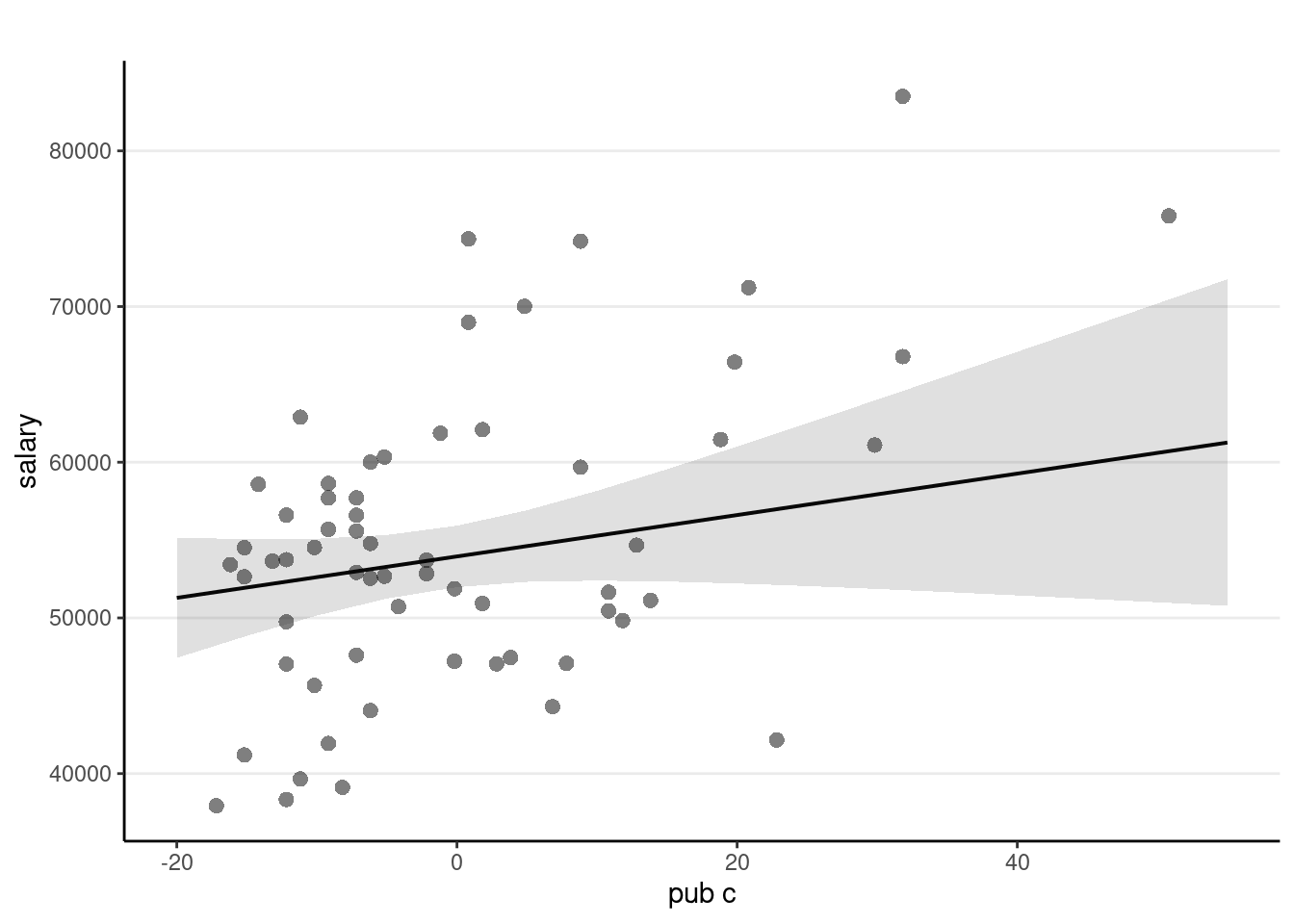

Centering

So that the intercept refers to a more meaningful value. It’s a major issue in multilevel modeling.

# Using pipe operator

salary_dat <- salary_dat %>%

mutate(pub_c = pub - mean(pub))

# Equivalent to:

# salary_dat <- mutate(salary_dat,

# pub_c = pub - mean(pub))

m1c <- lm(salary ~ pub_c, data = salary_dat)

summary(m1c)>#

># Call:

># lm(formula = salary ~ pub_c, data = salary_dat)

>#

># Residuals:

># Min 1Q Median 3Q Max

># -20660.0 -7397.5 333.7 5313.9 19238.7

>#

># Coefficients:

># Estimate Std. Error t value Pr(>|t|)

># (Intercept) 54815.76 1071.93 51.137 < 2e-16 ***

># pub_c 350.80 77.17 4.546 2.71e-05 ***

># ---

># Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

>#

># Residual standard error: 8440 on 60 degrees of freedom

># Multiple R-squared: 0.2562, Adjusted R-squared: 0.2438

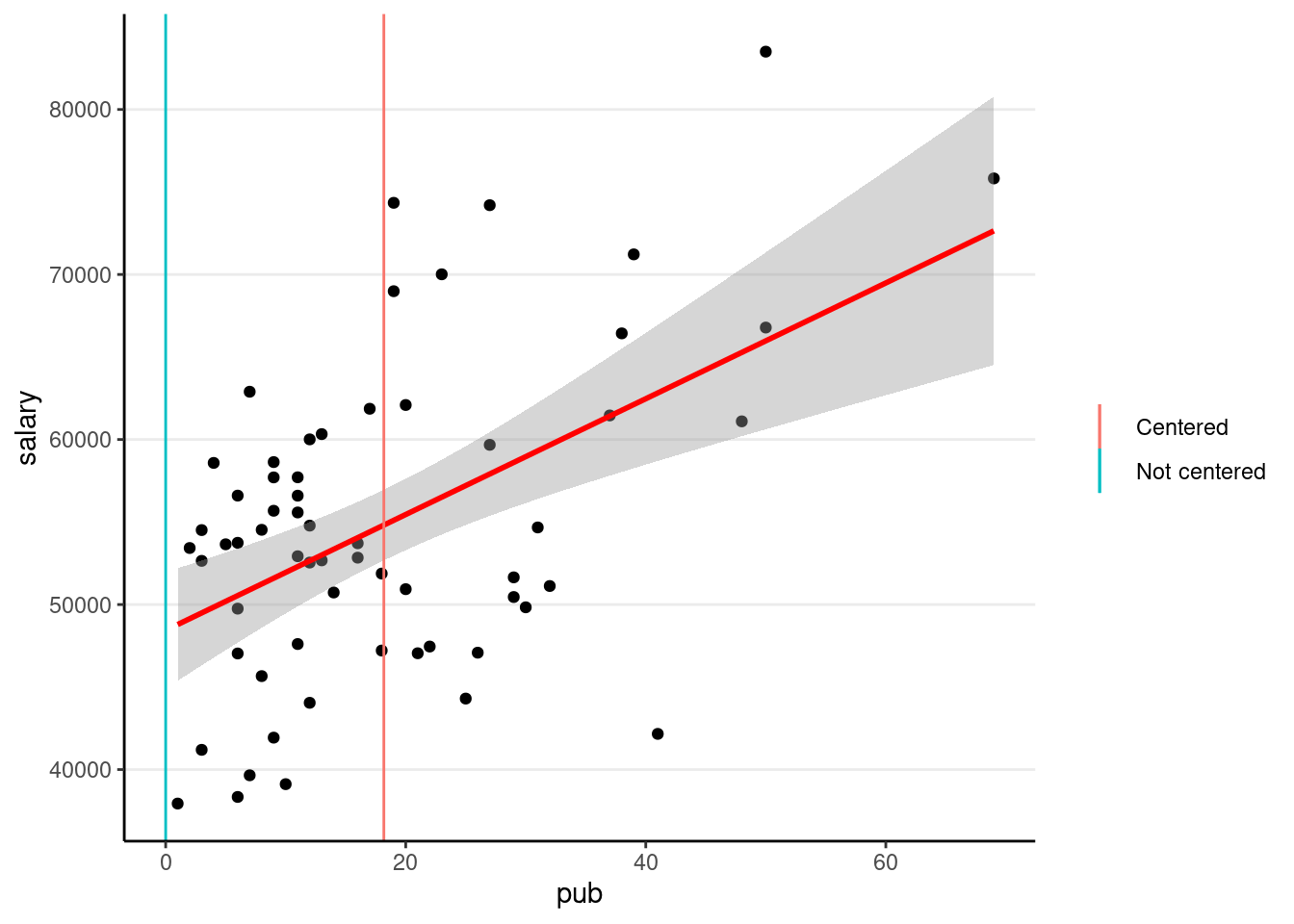

># F-statistic: 20.67 on 1 and 60 DF, p-value: 2.706e-05The only change is the intercept coefficient

p1 +

geom_smooth(method = "lm", col = "red") +

# Intercept without centering

geom_vline(aes(col = "Not centered", xintercept = 0)) +

# Intercept with centering

geom_vline(aes(col = "Centered", xintercept = mean(salary_dat$pub))) +

labs(col = "")># `geom_smooth()` using formula = 'y ~ x'

2. Categorical Predictor

Recode sex as factor variable in R (which allows R to automatically do dummy coding). This should be done in general for categorical predictors.

salary_dat <- salary_dat %>%

mutate(sex = factor(sex,

levels = c(0, 1),

labels = c("male", "female")

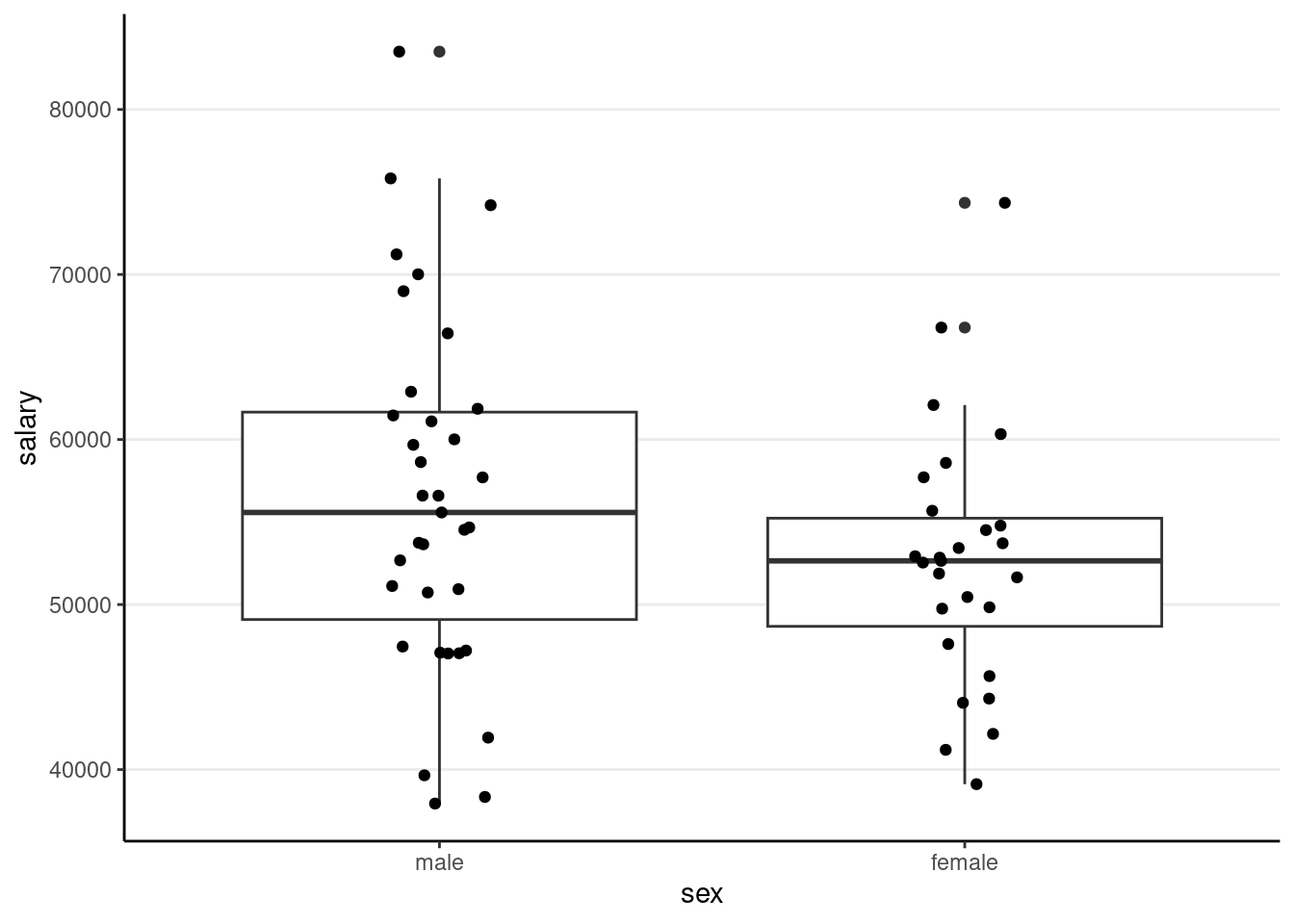

))(p2 <- ggplot(salary_dat, aes(x = sex, y = salary)) +

geom_boxplot() +

geom_jitter(height = 0, width = 0.1)) # move the points to left/right a bit

m2 <- lm(salary ~ sex, data = salary_dat)

summary(m2)>#

># Call:

># lm(formula = salary ~ sex, data = salary_dat)

>#

># Residuals:

># Min 1Q Median 3Q Max

># -18576 -5736 -19 4853 26988

>#

># Coefficients:

># Estimate Std. Error t value Pr(>|t|)

># (Intercept) 56515 1620 34.875 <2e-16 ***

># sexfemale -3902 2456 -1.589 0.117

># ---

># Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

>#

># Residual standard error: 9587 on 60 degrees of freedom

># Multiple R-squared: 0.04039, Adjusted R-squared: 0.02439

># F-statistic: 2.525 on 1 and 60 DF, p-value: 0.1173The (Intercept) coefficient is for the ‘0’ category, i.e., predicted salary for males; the female coefficient is the difference between males and females.

Predicted female salary = 56515 + (-3902) = 52613.

Equivalence to the

When assuming homogeneity of variance

t.test(salary ~ sex, data = salary_dat, var.equal = TRUE)>#

># Two Sample t-test

>#

># data: salary by sex

># t = 1.5891, df = 60, p-value = 0.1173

># alternative hypothesis: true difference in means between group male and group female is not equal to 0

># 95 percent confidence interval:

># -1009.853 8814.041

># sample estimates:

># mean in group male mean in group female

># 56515.06 52612.963. Multiple Predictors (Multiple Regression)

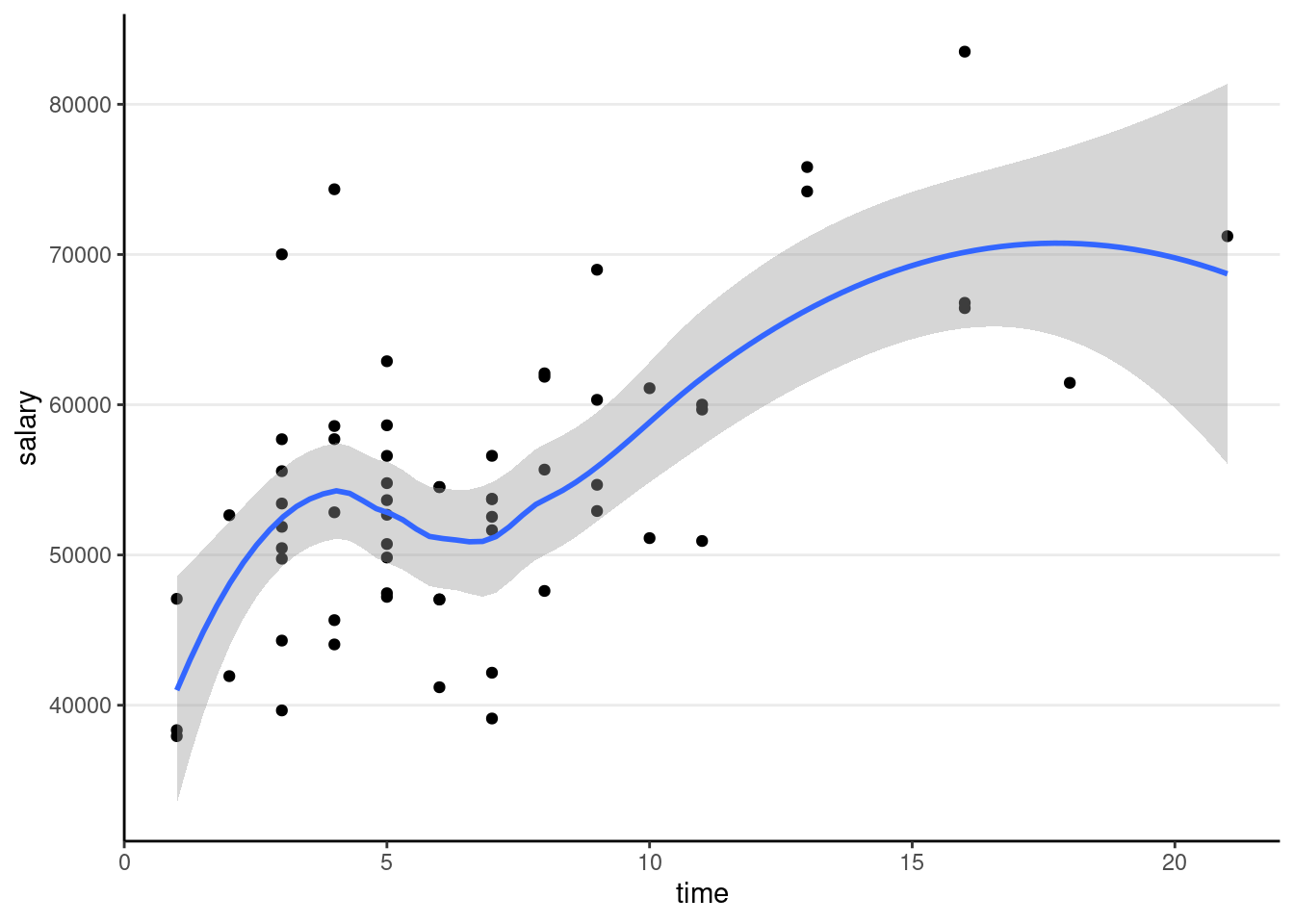

Now add one more predictor, time

ggplot(salary_dat, aes(x = time, y = salary)) +

geom_point() +

geom_smooth()># `geom_smooth()` using method = 'loess' and formula = 'y ~ x'

m3 <- lm(salary ~ pub_c + time, data = salary_dat)

summary(m3) # summary>#

># Call:

># lm(formula = salary ~ pub_c + time, data = salary_dat)

>#

># Residuals:

># Min 1Q Median 3Q Max

># -15919 -5537 -985 4861 22476

>#

># Coefficients:

># Estimate Std. Error t value Pr(>|t|)

># (Intercept) 47373.38 2281.78 20.762 < 2e-16 ***

># pub_c 133.00 92.73 1.434 0.156797

># time 1096.03 303.58 3.610 0.000632 ***

># ---

># Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

>#

># Residual standard error: 7703 on 59 degrees of freedom

># Multiple R-squared: 0.3908, Adjusted R-squared: 0.3701

># F-statistic: 18.92 on 2 and 59 DF, p-value: 4.476e-07confint(m3) # confidence interval># 2.5 % 97.5 %

># (Intercept) 42807.55413 51939.2044

># pub_c -52.56216 318.5589

># time 488.56251 1703.4921The regression coefficients are the partial effects.

Plotting

The sjPlot::plot_model() function is handy

sjPlot::plot_model(m3,

type = "pred", show.data = TRUE,

title = "" # remove title

)># $pub_c

>#

># $time

Interpretations

Faculty who have worked longer tended to have more publications For faculty who graduate around the same time, a difference of 1 publication is associated with an estimated difference in salary of $133.0, 95% CI [$-52.6, $318.6], which was not significant.

Diagnostics

car::mmps(m3) # marginal model plots for linearity assumptions

The red line is the implied association based on the model, whereas the blue line is a non-parametric smoother not based on the model. If the two lines show big discrepancies (especially if in the middle), it may suggest the linearity assumptions in the model does not hold.

Effect size

# Extract the R^2 number (it's sometimes tricky to

# figure out whether R stores the numbers you need)

summary(m3)$r.squared># [1] 0.3907761# Adjusted R^2

summary(m3)$adj.r.squared># [1] 0.3701244Proportion of predicted variance:

4. Interaction

For interpretation purposes, it’s recommended to center the predictors (at least the continuous ones)

salary_dat <- salary_dat %>%

mutate(time_c = time - mean(time))

# Fit the model with interactions:

m4 <- lm(salary ~ pub_c * time_c, data = salary_dat)

summary(m4) # summary>#

># Call:

># lm(formula = salary ~ pub_c * time_c, data = salary_dat)

>#

># Residuals:

># Min 1Q Median 3Q Max

># -14740 -5305 -373 4385 22744

>#

># Coefficients:

># Estimate Std. Error t value Pr(>|t|)

># (Intercept) 54238.08 1183.01 45.847 < 2e-16 ***

># pub_c 104.72 98.41 1.064 0.29169

># time_c 964.17 339.68 2.838 0.00624 **

># pub_c:time_c 15.07 17.27 0.872 0.38664

># ---

># Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

>#

># Residual standard error: 7719 on 58 degrees of freedom

># Multiple R-squared: 0.3987, Adjusted R-squared: 0.3676

># F-statistic: 12.82 on 3 and 58 DF, p-value: 1.565e-06Interaction Plots

Interpreting interaction effects is hard. Therefore,

Always plot the interaction to understand the dynamics

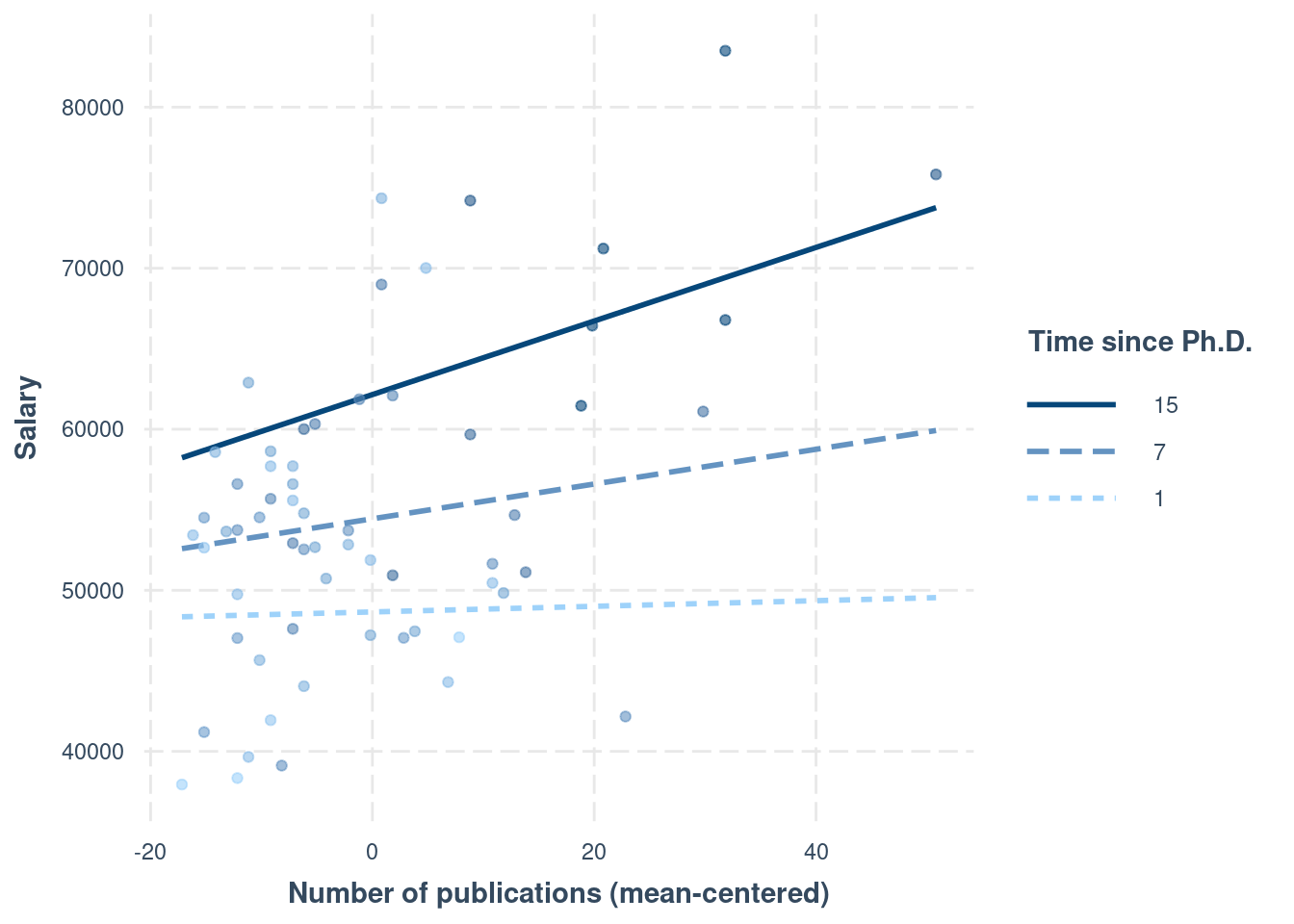

Using interactions::interact_plot()

interactions::interact_plot(m4,

pred = "pub_c",

modx = "time_c",

# Insert specific values to plot the slopes.

# Pay attention that `time_c` has been centered

modx.values = c(1, 7, 15) - 6.79,

modx.labels = c(1, 7, 15),

plot.points = TRUE,

x.label = "Number of publications (mean-centered)",

y.label = "Salary",

legend.main = "Time since Ph.D."

)

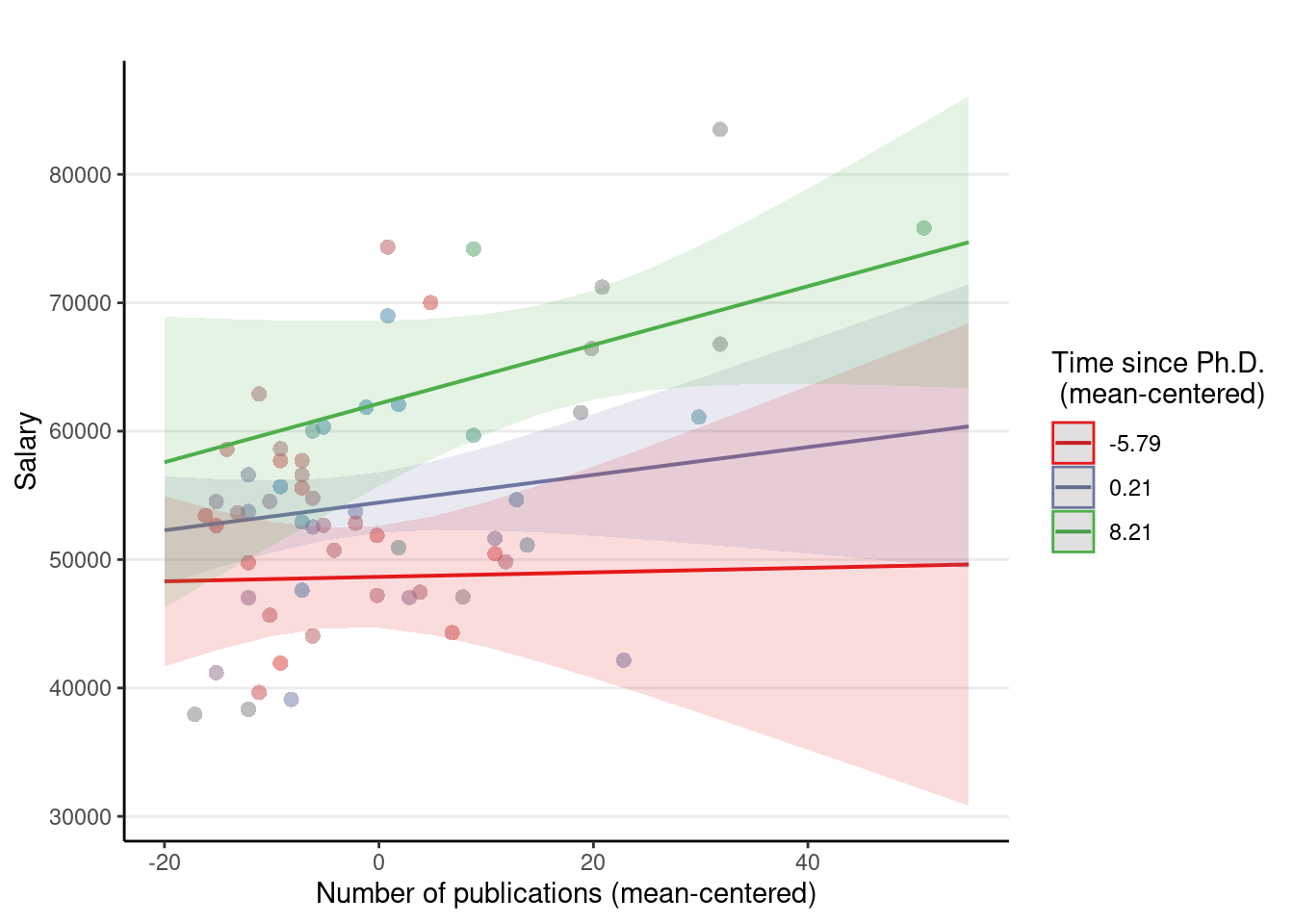

Using sjPlot::plot_model(..., type = "pred")

plot_model(m4, type = "pred",

# terms = c(focal_var,

# moderator [levels])

terms = c("pub_c", "time_c [-5.79, 0.21, 8.21]"),

axis.title = c("Number of publications (mean-centered)", "Salary"),

# "\n" indicates a line break

legend.title = "Time since Ph.D.\n (mean-centered)",

# suppress title

title = "",

show.data = TRUE)

Another approach is to plug in numbers to the equation: time = 7. First, be careful that in the model we have time_c, and time = 7 corresponds to time_c = 0.2096774 years. So if we plug that into the equation,

# beta0 + beta2 * 0.21

54238.08 + 964.17 * 0.21># [1] 54440.56# beta1 + beta3 * 0.21

104.72 + 15.07 * 0.21># [1] 107.8847resulting in time = 7. Note, however, when an interaction is present, the regression slope will be different with a different value of time. So remember that

An interaction means that the regression slope of a predictor depends on another predictor.

We will further explore this in the class exercise this week.

5. Tabulate the Regression Results

msummary(list(

"M1" = m1,

"M2" = m2,

"M3" = m3,

"M3 + Interaction" = m4

),

fmt = "%.1f" # keep one digit

)| M1 | M2 | M3 | M3 + Interaction | |

|---|---|---|---|---|

| (Intercept) | 48439.1 | 56515.1 | 47373.4 | 54238.1 |

| (1765.4) | (1620.5) | (2281.8) | (1183.0) | |

| pub | 350.8 | |||

| (77.2) | ||||

| sexfemale | −3902.1 | |||

| (2455.6) | ||||

| pub_c | 133.0 | 104.7 | ||

| (92.7) | (98.4) | |||

| time | 1096.0 | |||

| (303.6) | ||||

| time_c | 964.2 | |||

| (339.7) | ||||

| pub_c × time_c | 15.1 | |||

| (17.3) | ||||

| Num.Obs. | 62 | 62 | 62 | 62 |

| R2 | 0.256 | 0.040 | 0.391 | 0.399 |

| R2 Adj. | 0.244 | 0.024 | 0.370 | 0.368 |

| AIC | 1301.0 | 1316.8 | 1290.6 | 1291.8 |

| BIC | 1307.4 | 1323.1 | 1299.1 | 1302.4 |

| Log.Lik. | −647.486 | −655.383 | −641.299 | −640.895 |

| F | 20.665 | 2.525 | 18.922 | 12.817 |

| RMSE | 8303.15 | 9431.02 | 7514.48 | 7465.67 |

Bonus: Matrix Form of Regression

The regression model can be represented more succintly in matrix form:

head(salary_dat)id <int> | time <int> | pub <int> | sex <fct> | citation <int> | salary <int> | pub_c <dbl> | time_c <dbl> | |

|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 3 | 18 | female | 50 | 51876 | -0.1774194 | -3.7903226 |

| 2 | 2 | 6 | 3 | female | 26 | 54511 | -15.1774194 | -0.7903226 |

| 3 | 3 | 3 | 2 | female | 50 | 53425 | -16.1774194 | -3.7903226 |

| 4 | 4 | 8 | 17 | male | 34 | 61863 | -1.1774194 | 1.2096774 |

| 5 | 5 | 9 | 11 | female | 41 | 52926 | -7.1774194 | 2.2096774 |

| 6 | 6 | 6 | 6 | male | 37 | 47034 | -12.1774194 | -0.7903226 |

So

head(

model.matrix(m3)

)># (Intercept) pub_c time

># 1 1 -0.1774194 3

># 2 1 -15.1774194 6

># 3 1 -16.1774194 3

># 4 1 -1.1774194 8

># 5 1 -7.1774194 9

># 6 1 -12.1774194 6The coefficient

y <- salary_dat$salary

X <- model.matrix(m3)

# beta = (X'X)^{-1} X'y

# solve() is matrix inverse; t(X) is the transpose of X; use `%*%` for matrix multiplication

(betahat <- solve(t(X) %*% X, t(X) %*% y)) # same as the coefficients in m3># [,1]

># (Intercept) 47373.3792

># pub_c 132.9984

># time 1096.0273# Sum of squared residual

sum((y - X %*% betahat)^2)># [1] 3500978295# Root mean squared residual (Residual standard error)

sqrt(sum((y - X %*% betahat)^2) / 59) # same as in R># [1] 7703.156Bonus: More Options in Formatting Tables

Here’s some code you can explore to make the table output from msummary() to look more lik APA style (with an example here: https://apastyle.apa.org/style-grammar-guidelines/tables-figures/sample-tables#regression). However, for this course I don’t recommend spending too much time on tailoring the tables; something clear and readable will be good enough.

# Show confidence intervals and p values

msummary(

list(

"Estimate" = m4,

"95% CI" = m4,

"p" = m4

),

estimate = c("estimate", "[{conf.low}, {conf.high}]", "p.value"),

statistic = NULL,

# suppress gof indices (e.g., R^2)

gof_omit = ".*",

# Rename the model terms ("current name" = "new name")

coef_rename = c(

"(Intercept)" = "Intercept",

"pub_c" = "Number of publications",

"time_c" = "Time since PhD",

"pub_c:time_c" = "Publications x Time"

)

)| Estimate | 95% CI | p | |

|---|---|---|---|

| Intercept | 54238.084 | [51870.023, 56606.145] | <0.001 |

| Number of publications | 104.724 | [−92.273, 301.720] | 0.292 |

| Time since PhD | 964.170 | [284.218, 1644.122] | 0.006 |

| Publications x Time | 15.066 | [−19.506, 49.637] | 0.387 |